Get premium membership

Get premium membership and access revision papers with marking schemes, video lessons and live classes.

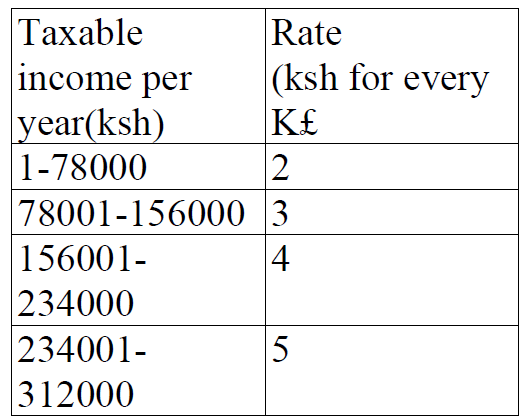

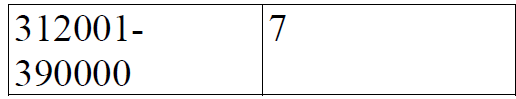

The table below shows the rate at which income tax is charged for all taxable incomes.

Mr. Karanja earns a basic salary of sh 18440 per month. He is housed by the company and therefore 15% of his monthly salary is added to his basic salary as taxable income. He is entitled to a family relief of sh 485 per month. Calculate how much income tax Mr. Karanja pays per month.